Datasets

The U.S. Securities and Exchange Commission (SEC) dataset

For this project, two datatsets were used. The first dataset consisted of the

U.S. Securities

and Exchange Commission (SEC) archives. It was possible generate a

.csv-like file listing, by company and date since the URLs in the SEC's archives, where the

investment portfolio filings are stored, has consistently structured text and HTML table data.

We were able to automate the extraction and so to get the type and scope of different types of asset

manager investment holdings (what companies they invested in, the size and value of each investment).

This data can be enriched by processing additional social data from twitter related to portfolio companies

into signals of their social impact and mapping these social impact signals to investment portfolios.

Based on this data from investment portfolio filings, we could identify and analyze investments

made in companies that pursue goals related to social good from all different kinds of industries.

Nevertheless, one need to be careful with the interpretation of the data. This data set contained

biases that one need to be aware of before drawing general conclusions from the data.

First, the data is collected quarterly and contains information about all the major players

of the US stock market. It would have been interesting to have the same kind of information

about Switzerland and the rest of the world also. However, the SEC dataset was the most

complete and consistent information we were able to find. Therefore, any conclusion that we could

make is likely to be true from the USA but not necessarily for the rest of the world.

Secondly, the dataset contains only the institutional investment managers with holdings over 100M

Furthermore, the 13F form is required to be filed within 45 days of the end of a calendar quarter

(which should be considered as significant information latency) only reports long positions

(not short) different investment managers pursue different strategies with may bias results.

However, the vast majority of investment managers rely significantly on long positions for significant

portion of fund performance.

Another drawback is that the 13F form does not reveal international holdings (except for

American depositary receipts) and excludes total portfolio value and percentage allocation of

each stock listed

The Section 13(f) securities generally include equity securities that trade on an exchange (including Nasdaq),

certain equity options and warrants, shares of closed-end investment companies, and certain convertible debt securities.

Shares of open-end investment companies (i.e. mutual funds) are not Section 13(f) securities

The official list of qualifying securities

Finally, it is necessery to point out at 13F does not represent the whole portfolio of the investos - it's a past snapshot.

The Twitter dataset

The twitter dataset consisted of the tweet from 2017. The research question that needed enrichment with social media data were all focused on the evolution throughout time of the opinion regarding selected companies. Therefore, we did not need to take the data from everyday. It was decided that it would be wiser and sufficient to take 10-days samples through the year 2017. This made the calculation feasible in Pandas. Since we were looking for information about investors and companies in the USA, we decided to only look at the tweet in English. This reduces the number of tweet per day by roughly 70% the majority of the Tweet are written in the mother tongue of the user (Chinese, Japanese, German, ...)

Data Story

In order to give some deeper insights to the information that we generated but also to make our workflow

easier to understand for the reader, we decided to split our data story in smaller data stories

called substories which are linked. The substories were set up in such a way that they all

answer one of our research questions. In fact, the whole substory in built around this question.

The first part of the substory is used to introduce and state the problem that we want to answer and

why it is interesting to studies this topic. These introduction should serve as teaser for the reader.

The used dataset is also explicitly mentioned in each document. This should make it possible for the

reader to eventually reproduce our experiments or at least to understand which dataset and which part of

it was used to get the information that we want to show.

Finally, the major part of the substory is

obviously dedicated to the graphs that we produced to answer the research question. Each graph comes

with a description of the phenomena but also with an interpretation of the results in order to conclude

something from the data regarding the research question.

Ultimately, our data story documents our journey into understanding the social good impact performance of large asset manager investors,

and how the prevailing public opinion supporting socially responsible investing may have influenced asset managers to be more socially impactful.

In order to explore these topics, we composed five questions, each of which are documented below as a data substory.

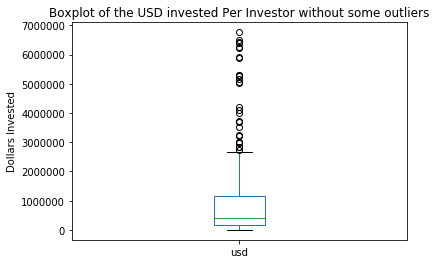

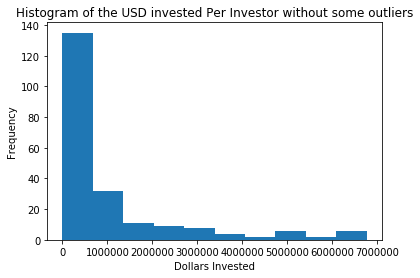

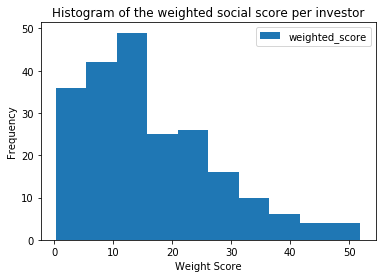

We first seek to understand the nature of our asset management investor social impact dataset.

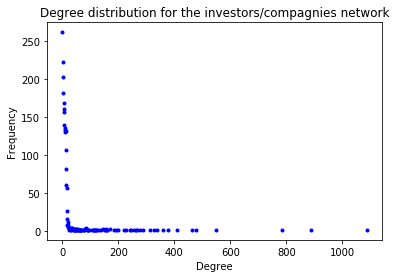

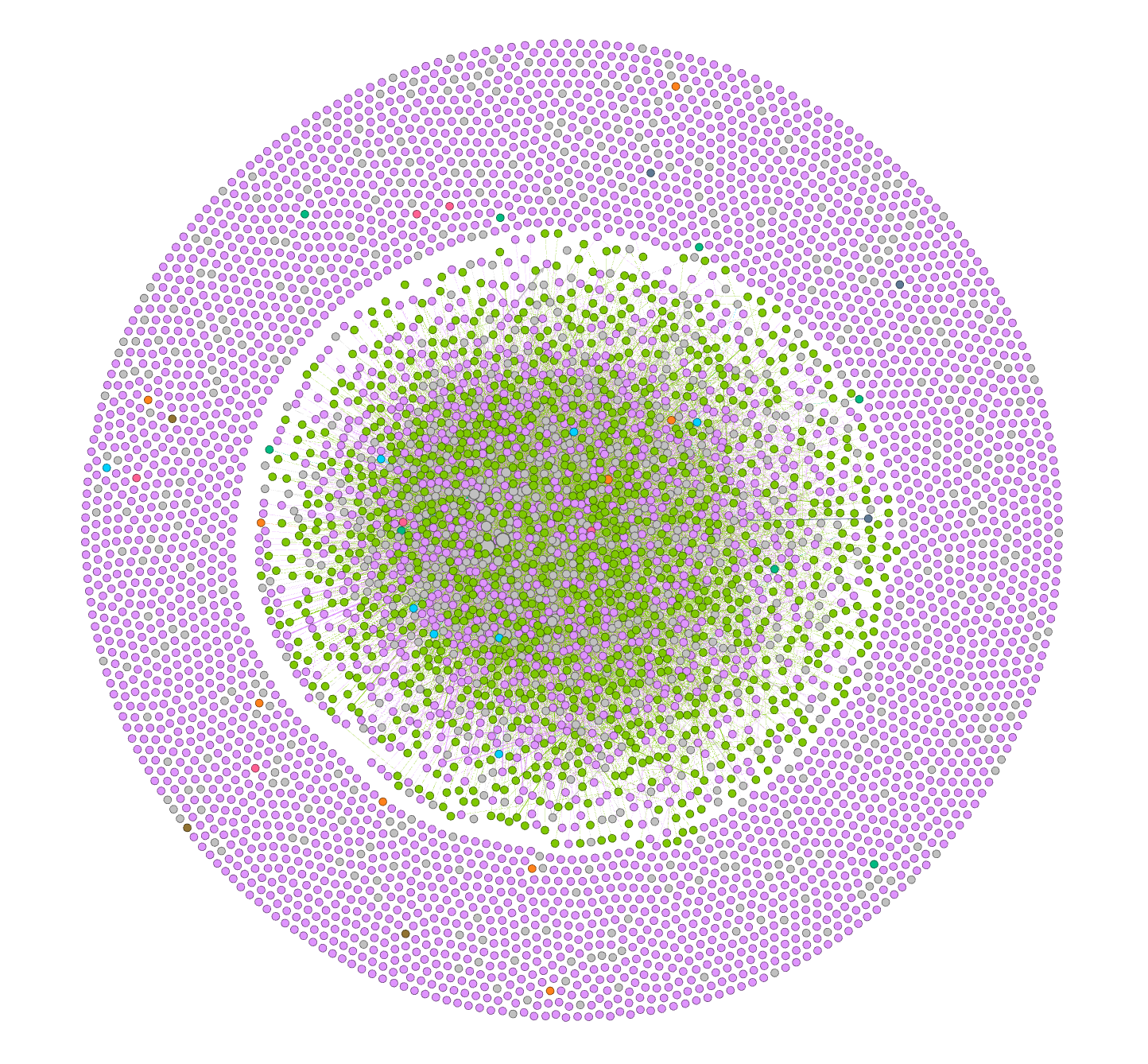

In this First part, the first research question of the project was described to in the

Who owns Who? substory.

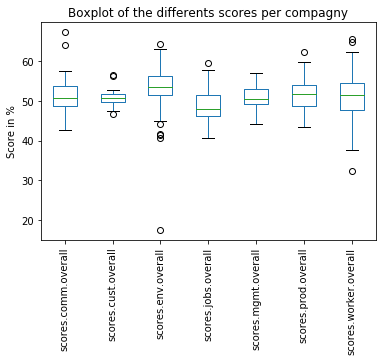

The aim of this story was to give to the reader a better insight of the data. Furthermore, the

way the data have been cleaned was presented. From the data it saw possible to observe that, for example,

the lowest scoring investor had a very specialized investment strategy (event-driven investing).

On the other end of the spectrum, the highest scoring investor, Aetna Inc, is a healthcare company,

and is thus intrinsically driven to invest based on values aligned with social impact outcomes.

After this first part dedicated to data exploration, we attempt to understand the nature

of high and low social impact investments in an asset manager's portfolio. For example, why do these investors choose

to invest in certain stocks that bring a positive impact, or are detrimental to society? And what is the logic behind these motivations?

This the second substory is also prefaced by a definition of

the terms ethics and assets since these terms will follow us all along of our journey through the

data. Through The Asset Manager's Portfolio substory,

we show the popularity of the high and low impact stocks and we ended up showing that an investor

could easily end up selecting a portfolio with more high social impact investments simply based

on looking for stocks with high historical financial growth - technology companies such as Amazon and Apple.

Although The Asset Manafer's Portfolio data substory allowed us to observe a pattern of asset management

investors making greater numbers of high social impact investments than low social impact investments, this conclusion was specific to 2017. In order to determine if investments

in social good are a recent trend or if there is a tradition to invest in ethically favorable assets

we chose to compare the data of the previous year. By doing so in the Towards Social Good substory,

it was possible to see that investors do not seem to be, as a general trend, shifting towards higher social impact investments.

But what does the great public think about these investors. Does the great public care about

the ethics of the companies from which they are buying product? In order to answer this sentiment analysis

on the Tweet of 2017 was used. The data we found is show in Sentiment Analysis.

It was very interesting to see how tht great public thinks about the assets. However, no clear correlation

between social opinion and social score was to be determined.

Finally, the geographical location of the most ethical companies was also studied in the Investment Geography of the USA.

It was possible to see that there was not clear geographical trend regarding social score and

geographical location of the companies.

As an teaser for further work and what could be added to our project we created the

Other Countries substory.

The aims would be to make the same kind of research for other countries. Therefore, we invite all curious

readers to extend our project by forking our project on github.

Data Exploration & Substories

The project was centered around research questions which were answered in these different sub-data stories

Conclusions

1. Consider what ethical means

There are many different criteria of “ethical” under which to categorise a fund and businesses that involve nuclear energy, animal testing or tobacco are some of the commonly screened-out industries when people are thinking of ethical investment. But before you can sensibly choose an investment fund that may match your profile, you need to ask yourself if you are against an alleged cause for a higher purpose or just for the sake of going against it.

Socially Conscious Investing

Many investors who seek to avoid what they consider to be unethical investments look to vehicles such as socially

conscious mutual funds that screen companies according to specific ethically-based criteria. Many such funds are offered

by religious denominations such as the Lutheran Brotherhood, which typically avoids investing in any of the "sin" industries listed above and can provide investors with a clear conscience in this area.

2. Carry out research

Some fund managers have strong teams looking into socially responsible investment, some aim to filter out redundant funds, while others actively invest in companies working in areas such as pollution control, clean fuel and healthcare services. Carry out research and do a background search before deciding to invest in any of the green sectors that might be of interest to you. Ethical investors favor companies that replace what they

take from the earth and adhere to governmental standards for emissions.

3. Consider an ethical IFA

If you are not comfortable choosing investment funds, consider taking some advice from ethical IFAs or look for an IFA who specialises in ethical investment.

4. Determine your attitude to risk.Review and reflect on your attitude to risk.

If you are a low-risk investor, you might want to avoid stocks and shares altogether, while aggressive investors would consider investing in high-risk companies such as renewable energy start-ups.To reduce risk, diversify your funds or sectors and spread your investments around different funds, sectors or even geographical areas.

5. Choose a fund manager carefully

Investors should look into a manager’s ethical criteria and see if these are rigorous, or if the fund has a specialist team or if it has a position on new investment opportunities such as biofuels, organic food, climate change, waste, and water, and so on.

About

This project was done in the frame of the Applied Data Analysis Course of 2018 at EPFL

-

SEPTEMBER - NOVEMBER 2018

Our Humble Beginnings

Basics and fundamentals of Data Analysis were studies in class during the course. Four different graded homeworks were supposed to guide the students through the course material

-

NOVEMBER 2018

Milestone 1

The project repo contained a README describing your project idea (title, abstract, questions, dataset, milestones, according to a provided skeleton).

-

LATE NOVEMBER 2018

Milestone 2

the project repo contains a notebook with data collection and descriptive analysis, properly commented, and the notebook ends with a more structured and informed plan for what comes next (all the way to a plan for the presentation). These sections of the notebook should be filled in by milestone 3.

-

DECEMBER 2018

Final Report

Data story in a platform of your choice (e.g., a blog post, or directly in GitHub), plus the final notebook

-

Be Part

Of Our

Story!

Our Amazing Team

"Talent wins games, but teamwork and intelligence win championships"

Our team was composed of three Masters students coming from EPFL. We all have different different

backgrounds and it was great fun to work together during this project.

David Cleres

Computationnal Science & Engineering (CSE)

Mike Jiao

Computer Science (CS)

Nicolas Lesimple

Computationnal Science & Engineering (CSE)

We wanted to take this opportunity to thank you as a reader for taking the time to read what we

had to tell. Furthermore, we wanted to thank the whole ADA Teaching Stuff for the great job that

they did all along of the semester. It is certainly one of the most time consumming classes at EPFL

but we learn a lot of thing for the future.

Merry Christmas !